Streamline Integration and Enhance Efficiency Seamlessly integrate your banking systems with SynapseIndia's advanced middleware API development solutions.

Our expertise in technologies such as RESTful APIs, JSON, OAuth2, and microservices architecture ensures efficient and secure communication between your banking applications, enabling streamlined integration and enhanced operational efficiency.

Middleware API development for banking services involves creating and implementing software solutions that act as intermediaries between different banking systems. These APIs facilitate seamless data exchange, secure information sharing, and smooth workflows across the banking ecosystem. At SynapseIndia, we leverage cutting-edge technologies and industry best practices to develop custom middleware APIs tailored to the unique needs of your banking infrastructure.

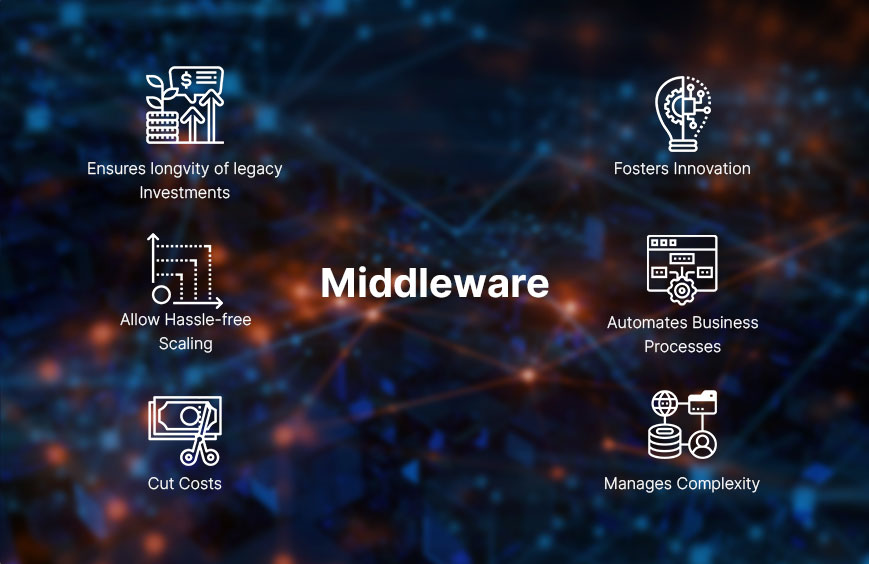

Connect With an ExpertBy partnering with SynapseIndia for middleware API development, you can unlock a range of benefits for your banking institution:

When you choose SynapseIndia as your middleware API development partner, you benefit from our expertise, technology focus, and commitment to delivering exceptional solutions:

Feel free to reach out and get a proposal for your project.

We would love to be part of your success story.